A Key Part of Your Estate Plan: The Beneficiary Designation

After you have signed your estate planning documents, you still have more work to do. Where will you keep original documents? Who will get copies? But here’s a topic that too often gets overlooked: the beneficiary designation. What is at issue Perhaps your will or trust directs that a particular bank account is to be […]

Guardianship Not Required With Power of Attorney in Place

We’ve written before about why you might want to avoid guardianship proceedings. They are expensive. More lawyers, judges and court-appointed officials are involved than most people would like to have in their lives. If you planned in advance, you probably would not choose a cumbersome, invasive and public legal proceeding. How can you avoid guardianship? […]

Lawyer Entitled to Hearing Before Being Ordered to Disgorge Fees

When a court decides that a lawyer should return fees improperly collected, the usual term comes with powerful imagery. The lawyer is usually ordered to “disgorge” those fees. Courts are very protective about the fees charged in probate, guardianship and trust administration matters. Lawyers often find themselves having to justify their fees. An order to […]

Court Rejects Trustee Removal Petition in Family Dispute

When our clients sign living trusts, they usually are thinking about how to simplify legal proceedings. Trusts normally are not subject to court supervision, which helps save court costs and fees. Without court oversight, though, the trustee of a trust can sometimes get crosswise with the beneficiaries. When things reach too difficult of an impasse, […]

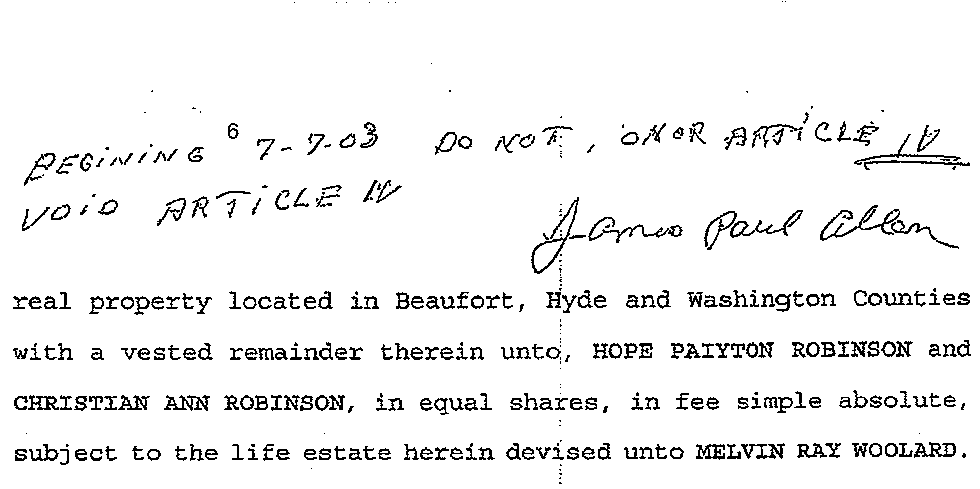

Please Don’t Handwrite Changes On Your Will

Arizona law allows you to sign a “holographic” will (or a holographic codicil). That means you can handwrite your own will and sign it. Such a will or codicil does not need the two witnesses usually required. So that means you can easily write — or change — your will yourself. Right? Please do not […]

Will Contest Fails, But Paternity Remains an Issue

Based on popular cultural references (and especially novels, television and movies), it might seem like will contests are commonplace. In fact, very few wills are contested. When a will contest is filed, it is seldom successful.The risk that someone might contest your will is very slight — but it does happen. The background story in […]

Ambiguous Residuary Clause in Will Causes Difficulty

Your will should accomplish at least three simple things. It should identify who will manage the estate (the “personal representative”, in Arizona). The will should identify individual items, dollar amounts or percentages that are to go to particular recipients. Finally, the will should include a “residuary clause” — a statement about who will receive the […]

Personal Liability for Acting as Personal Representative

When you agree to act as personal representative of a decedent’s estate, do you take on any potential personal liability? Generally not, but you should make sure everyone knows that you are acting as a fiduciary. A recent Arizona case illustrates the risk if you do not. Estate’s property is sold When Gary Barnes (not […]

Beneficiary Deed Can Help Avoid Arizona Probate

Like a number of other states, Arizona permits a real estate owner to sign a deed that transfers property automatically at death. This type of deed, often referred to as a “beneficiary deed,” is revocable during life, but can help avoid the probate process on the death of the owner. So does that mean every […]

Trust Benefiting Lawyer Creates Undue Influence Presumption

VOLUME 24 NUMBER 21 To be valid, a will or trust must reflect the intentions of a competent signer. If the signer is deemed to have been subject to the undue influence of someone else, the document can be invalidated. Even documents carefully prepared by lawyers sometimes get successfully challenged. When the lawyer is a […]